“Reflecting on nearly a decade in the business aircraft financing space, I’ve seen numerous cycles. When I first started in this field, we were still in the shadow of the Great Recession. This experience was the driver of most lending challenges – but so much has happened in the last 10 years: unprecedented and rapid shifts from ‘normal market conditions’ to major disruption. Let’s take a look together as this sector is once again starting to normalize.”

– Kyle O’Donnell, Director of Business Development – JSSI Aviation Capital

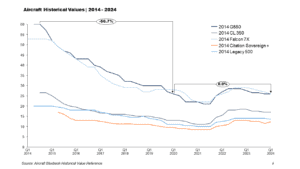

Pre-2020, jet values followed a steady depreciation curve that was considered ‘normal’ for the market. Original equipment manufacturers (OEMs) saw a steady ramp-up in new deliveries which helped stabilize values before it was substantially upended by the supply shift in March 2020.

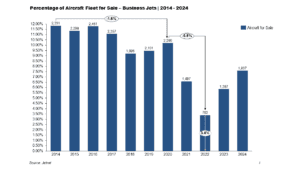

Supply chain challenges slowed OEM new deliveries and had a knock-on effect on pre-owned aircraft market inventory, driving it downward to meet newfound demand. Utilization jumped higher and aircraft owners became reluctant to sell their jets due to inability to find a replacement jet. This caused aircraft listings to dry up. As seen below, inventory levels dropped significantly in 2022.

During COVID, the perceived health exposure from flying commercial brought new entrants to business aviation; demand increased during a time of tightening supply, and as a result – values jumped at an unprecedented rate. As seen below, depreciation turned into short-term appreciation.

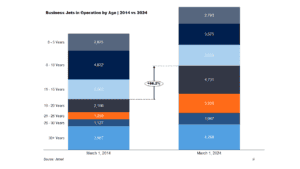

Business aircraft were trading quickly and often in off-market transactions. This caused challenges to finance aircraft. Appraisers began viewing transactions from the past few days as the only reliable market data, and even then, it was difficult to get an accurate read on the market. Compounding this, the fleet has continued to age, mostly with ‘pre-2008 financial crisis’ aircraft getting past their 16-year vintage. According to JETNET, 9.25% of all the aircraft fleet were between 16 and 20 years old in 2005. Fast-forward to 2023, that number doubled to 18.32%.

The spike in utilization drove other impacts across the industry. Maintenance capacity was tested and demand for pilots was higher than ever – putting pressure on charter operators. Even on the fractional side, demand was at a record high; NetJets even temporarily stopped selling new jet cards in 2021. While the industry has normalized since, demand for business aviation continues to be high compared to historical levels. Today, many charter and fractional players are going to the public markets to raise funds.

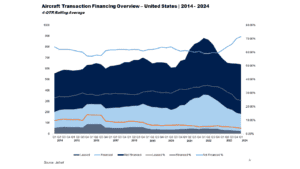

“When I first started in this field, lending was coming back after taking a big hit in 2008. Interest rates had remained low for years and financed aircraft transactions continued to trend toward 30% of all sales. Obviously, aircraft lending also changed as a result of the pandemic – adapting to the new speed of transactions. During the worst of the low inventory challenges, the financing process often wasn’t quick enough to secure a closure on an aircraft purchase. Transactions were thus bought with all cash, with back-leverage added post-closing in some cases. The rapidly rising aircraft values also caused lack of conviction on residual values, driving a more conservative approach from lenders who experienced the 2008 financial crisis – different factors led to these two events, but both saw rising asset values.”

Traditionally, aircraft finance in the U.S. has been driven largely by regional banks focused on client-relationship value. However, in some situations, lack of expertise on the assets themselves has caused some lenders to opt-out of participating in business jet transactions. Compounding this, several regional bank failures in 2023 resulted in stricter lending standards. Globally, some consolidation happened in the banking space as well (e.g. Credit Suisse was absorbed by UBS) – pulling out a significant aircraft lender from emerging market regions. All of this against a backdrop of rising rates limited financing options for buyers. Although rates have stabilized over the last few quarters, aviation finance options not kept pace with the growth of the rest of the industry.

The lending market will continue to respond to changes in on inventory, residual values, and economic trends. Going forward, a major challenge that persists for lenders is that many purchasers who would have looked for financing in the past, have cash on hand or alternative lending sources today. This has led to a steady decline in the percentage of transactions that are being financed since the end of 2022.

Looking at current trends and historical performance, we expect that traditional loans will remain the most popular option for aircraft financing. Other lending options continue to exist and could help fill gaps in the market that have appeared over the last five years.

Asset-based financing can be a good alternative to traditional bank loans. In simple terms, asset-based financing structures lend against the aircraft value versus the creditworthiness of a borrower. This underwriting approach tends to be quicker, thereby allowing buyers to move at speed through a transaction. Charter operators can acquire new aircraft even if they don’t have strong balance sheets. And owners can finance aircraft beyond the age range of traditional banks and in jurisdictions outside the U.S. as markets continue to return to “normal”. Asset-based financing for business jets provide options for buyers with complicated business structures, those looking for limited guarantees, or those seeking to finance classic aircraft.

“As we emerge from another unprecedented cycle (I think we all thought the market would stay “normal” forever), it is exciting to see how the business aviation industry has remained resilient growing with opportunities and adapting to setbacks. We are most likely now in a period of normalcy, but a lot of lessons have been learned through the turmoil. To quote the Greek philosopher Heraclitus – ‘There is nothing permanent except change’; JSSI Aviation Capital is uniquely positioned to offer customizable structures that fit any operation and move at speed.”

Contact us at JSSI Aviation Capital to discuss financing options.

Sources:

About JSSI

For more than 35 years, Jet Support Services, Inc. (JSSI) has been the leading independent provider of maintenance support, advisory services, software, and financial tools to the business aviation industry. With 6,000+ aircraft supported by maintenance programs and software platforms, JSSI leverages this wealth of data, scale, and innovation to drive cost savings and provide custom solutions that align to the interests of each client, regardless of make or model. Learn more at jetsupport.com.

JSSI products and services include:

Maintenance Programs. Hourly Cost Maintenance Programs to stabilize maintenance budgets, maximize aircraft availability and enhance residual value.

Parts & Leasing. Experienced product line specialized team who leverages our All-OEM inventory and global vendor relationships and go beyond parts sourcing to find optimal customer solutions.

Software: Traxxall and Conklin & de Decker. Powerful data platforms to help you make more informed decisions, from choosing the right aircraft to tracking your maintenance, inventory, and MRO projects.

Advisory Services. Objective insights and independent technical advice from a global team of technical advisors and ASA-accredited appraisers for virtually any business jet, turboprop or helicopter.

Aviation Capital. Customized asset-based finance solutions for business aviation.

Contact I JSSI Communications

Isabella Rimton [email protected]

JSSI’s Hourly Cost Maintenance (HCM) Programs bring peace of mind to owners and operators of virtually any business aircraft. Our programs are designed to stabilize your maintenance budget, maximize availability, and enhance the residual value of your aircraft – offering flexible coverage options:

Engine I APU I Airframe I Tip-to-Tail®